The same consumer forces that brought us bell bottoms, Beanie Babies, and the Macarena also influence the drug development cycle. “Fashionable” drugs—and the attention they garner—generate real impacts on consumerism, regulatory priorities, and by extension, future therapy pipelines. As demand for COVID-19 vaccines nears the peak of its natural curve, we find ourselves wondering “What comes next?” We take a look at why and how a drug trend unfolds to help predict regulatory shifts and prepare for resource gaps before they happen.

CONTINUE READING OR DOWNLOAD OUR INFOGRAPHIC

SPOTTING TRENDS

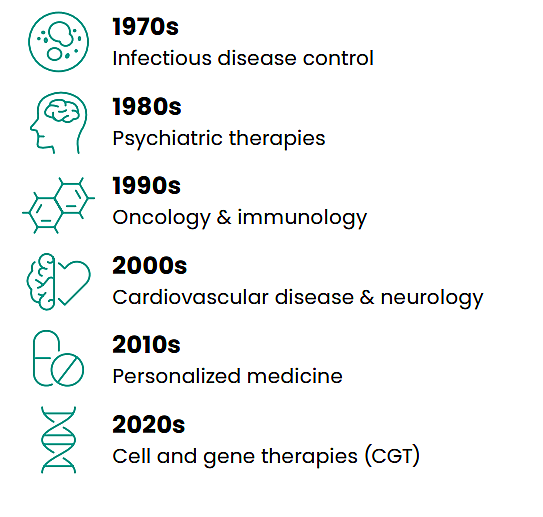

Drug trends may be easier to spot in hindsight. One observational study of FDA drug approvals notes “a wide variation in the number and category of approval” over two decades. However, closer examination reveals periods of time—marked periodicity—where self-similar categories emerge. Think cholesterol statins in the late 80s and early 90s. Therapeutic focus areas shift over time, and they bring regulatory priorities along for the ride.

SPARKING TRENDS

Biopharmaceutical firms weigh countless factors in deciding when and where to invest in R&D. Three key considerations include:

1. Therapeutic potential – volume of evidence and positive signals

2. Maturity – how close to market the potential solutions are

3. Competitive landscape – “white space” opportunities for unmet demand

The development landscape exists in a state of constant flux. Thus, any time a firm can recognize—or catalyze—a trend, the more likely they are to capitalize on it.

LOOKING FOR AN EDGE

Developing new drugs is expensive and risky. It’s no wonder biopharmaceutical firms want to build a bandwagon for consumers to jump on. To analyze where spikes might occur, developers increasingly turn to artificial intelligence. AI is used to analyze the fundamental requirements of a drug product from a consumer’s viewpoint, as well as to forecast sales and promote awareness.

WHAT’S HOT NOW

Right now, there’s a perfect storm of factors creating buzz around cell and gene therapies, including low interest rates, intrigue around gene editing, and the lure of lucrative pricing models. There are currently more than 900 active investigational new drug (IND) applications involving gene therapy products, and the size of the global biologics market is growing at close to 10%. Ultimately, this investment is expected to fuel 10–20 FDA approvals by 2025.

OPENING THE FLOODGATES

The FDA has tools in its arsenal to speed up approval for trending and high-potential therapies, and it’s prepared to use them—as was made crystal clear with COVID-19 vaccines and therapies. “The use of fast track, accelerated approval, and priority review programs have also been steadily increasing since 2000,” notes Researchgate.

“It’s amazing to see the shift in investigational resources and energy that comes along with a promising new modality or mechanism of action,” says Dr. Ben Locwin, Life Science & Technology Subject Matter Expert, Black Diamond Networks. “Developers who capitalize on all the channels available to them—from research analytics to regulatory priorities—stand to accelerate commercial success.”

MARKETING SPEND FUELS THE FIRE

As drug trends pick up momentum, advertising dollars flow. Big pharma spends more than $20 billion each year to persuade doctors and other medical professionals of the benefits of prescription drugs. Since the first prescription drug ad for Rufen (ibuprofen) appeared on TV in 1983, consumer drug marketing has also exploded. Remember the purple pill? The bathtub silhouettes? The Nasonex bee? Jon Bon Jovi for Advil? Ars Technica reports “What’s new—and why this is now a shadier situation— is the explosion of direct-to-consumer (DTC) marketing that couples with those efforts for a one-two marketing punch.”

A SELF-PROPELLING CYCLE

As interest spikes and critical mass builds, investment money flows in, more firms get in the game, and more projects get funded. Follow the money to spot the rising trends. For example, regenerative medicine saw dramatic increases in funding and public interest from 2019–20.

NEW INSIGHTS

What else is trending upwards? Locwin says:

- I’m seeing more Dynamic Clinical Trial Design, and greater use of Data Science – both in the industry and with FDA’s DMAP (Data Modernization Action Plan).

- Oncology has been – and will be – making greater use of pharmacogenomics and the newer biomarkers identified within the cancer realm to accelerate targeted cancer therapies.

- Risk Management and Ethics are emerging and growing themes in the Clinical Operations hiring market, giving us insight into where we can best place expertise.

- Based on clinical trial status, and newly-initiated clinical trials, the most activity is occurring in the respiratory space, hypertension, bacterial infections, and diabetes. But many other therapeutic areas such as inflammation and oncology are still high on my list.

- Financing within public and private deals in biotechnology set new records in 2021, and this money is going to areas such as boosting the number of Phase 3 trials and commercialization of more cell and gene therapy (CGT) treatments.

NOT SO FAST

As interest scales upward, so must capacity. Expedited approval of anticancer and biologics is seen as a recent trend in drug development, but we already see evidence of supply chain challenges and production constraints in these sectors. According to the Alliance for Regenerative Medicine, “…the complex manufacturing process for cell and gene therapies—and the regulatory environment surrounding it—remains a key challenge for the sector.” It’s no surprise that using outsourced CRO and CDMO services has become the norm in the industry.

AHEAD OF THE WAVE

At every stage of an accelerating drug trend, BDN is there. From proof of concept to full-scale production, we provide highly skilled consultants to regulated industries. Our life sciences team helps you prepare workforce strategies that anticipate trends, respond to disruption, and reflect changing FDA priorities.